“Do not try and bend the spoon, that’s impossible. Instead, only try to realize the truth…there is no spoon. Then you will see it is not the spoon that bends, it is only yourself.” – Spoon boy, the Matrix.

There is no reality, there is only your perception of reality. To bend the world to your will, you need to change your perception of how the world works.

In the last two weeks, we’ve had some big events that changed the world a little bit:

FTX went from a $32B market leading crypto exchange to effectively zero in four days. It also looks like there was fraud that resulted in the destruction of customer deposits. So much ink has been spilled on this, and I’ll minimize the amount that I contribute, but wow.

In the same week, Elon Musk finally closed on Twitter for $44B (!!), and subsequently shed most of it’s employees and a huge chunk of its revenue overnight.

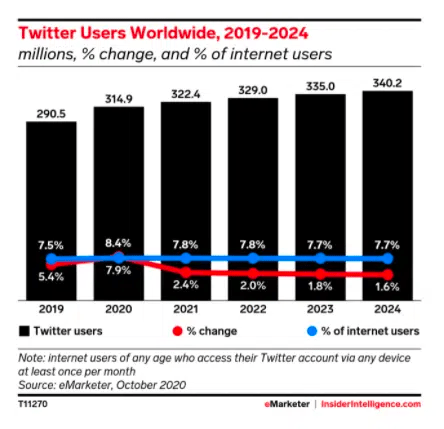

If you asked anyone who knew anything about Twitter’s product, business and team, they’d probably tell you that the product hasn’t evolved, there were more employees than necessary and that the company was faltering on user growth, but it was still a growing business:

This looks like a company that’s maturing. Audience growth is slow, and the company needs to either take new risks to restart user growth, or start managing the company as a low growth media business moving forward (high ARPU, high margin, cash-flow generating). The most obvious strategy for Twitter was the latter: a private equity takeover, cost-reduction measures, ARPU optimization and cash-flow management.

Instead, when Elon Musk took over employees and advertisers both went flying out the door. Overnight, Twitter could go from 7,500 employees and ~$5B in annual revenue to maybe 1,000 employees, and almost certainly lower revenue than what it had at the time of the acquisition. There’s a ton of focus right now on the changes to the employee count. The revenue loss side seems to be the bigger question as it digs the valuation hole deeper, and it’s unclear how he’ll be able to make that revenue back. If revenue is dropping, the multiple it’ll earn by investors is going to be low. Getting back to $44B is going to be a moon shot.

How are these two events linked? For me, a key skill of most entrepreneurs is the ability to “bend the spoon”. It’s a shared trait of the Founders we idolize, as well as the ones we vilify. We’ve watched Musk do it with payments, EVs and space travel. He’s going to do it again to Twitter. It may succeed or fail, but it’s certainly going to change dramtically.

In the case of SBF, everyone saw him in a similar light to Musk a month ago. Spoon-bending good. Now he’s spoon-bending evil.

I think that trait is the difference between highly disruptive Founders and most people – they see something other than what’s obvious to the rest of us, because they don’t seem to think the world has any rules. Over time as I’ve been exposed to more entrepreneurs, and seen the fine line between genius and fraud, I’ve tried to keep my mind open to what’s possible on the upside and the downside. I continue to remind myself that there are very few concrete laws of gravity, particularly when looking at early stage ventures and the entrepreneurs who found them. As a result, I really don’t discount any idea. It doesn’t mean they all warrant investment of time or money, but we really have no idea what the future could bring.

I was reminded of that this week.

Leave a comment