When we hit the slower week between Christmas and New Years, one of my personal traditions is reflecting on what happened, and thinking about what could happen next year. For me, the benefit of this exercise is to pick my head up, look around, and try to make sense of the world.

Last year as this time I wrote up what I thought could happen in tech, markets, and geopolitics. Here’s how I did on last Decembers’ 2022 predictions.

Prediction 1: The “Copy-Paste” Crowd Gets a Win: NFTs will experience their bust phase in the cycle. We’ll see some major price corrections in the NFT space as people pull back on speculation. To put a metric on this, I think we’ll see Bored Ape pricing floors drop below $100k, from their current $228k.

Final Grade: ✅✅ Correct.

This price floor prediction came through in June. The price popped back up for a month or two, but is now hovering around $61k, down 73% from the price one year ago. I don’t have a long term view on Apes, or on NFTs in general, but I do believe that all new technologies seem to undergo a cycle of exuberance and speculation, and NFTs (as well as ETH, which supports the pricing) have not been an exception. Longer term, I’m confident we’ll see winners in crypto, but I have no predictions on what or who those winners will be. Anyone speculating in the category should probably buy a basket of tokens.

Prediction 2: The New White Collar Economy: The shift to hybrid and remote work will accelerate, despite the pandemic largely moving into its likely permanent state of “always around but somewhat manageable”. Companies that can will have smaller office footprints, and make in-office optional for most employees. The migration from high-tax large cities to lower tax mid-sized cities and states will continue, with net migrations out of places like New York and San Francisco and into suburbs and mid-sized cities like Austin, Charlotte, Portland and others where people can get a bit more space for WFH offices, etc. This change will continue over the next decade, but by the end of 2022 we’ll see more reports of net migrations out of traditional work centers and into smaller ones.

Final grade: 🤷🏻♂️ Unclear

Tracking net migration data for the current year is difficult, which I learned when trying to verify how I did on this prediction. The most current info I could find was pulled from this Atlantic article, which has some data, but none of it definitively supports the argument that white collar workers are leaving major cities at scale. In New York, rents are up (possibly inflation), restaurants seem completely booked, and commuter trains appear pretty full. I’ll revisit this in 6-months when more objective data becomes available.

Prediction 3: Automation Nation: AI and automation adoption will accelerate. The rising cost of labor is changing the P&Ls of companies in many labor intensive industries (retail, manufacturing, etc). This shift will impact how these companies make decisions around automation and AI investment. Every company will start to look for ways to do more with fewer humans. I don’t have a great objective metric, so I’ll say that we will double our number of enterprise customers deploying some level of NLP-based automation at Quiq, and you’ll have to trust me when I report back.

Final grade: ✅ Mostly Correct

The theme of the past year has been intelligent automation. Businesses are deploying more automation flows for repetitive customer service inquiries, and without sharing confidential information, brands are investing heavily in opening digital channels and automating more of their volume.

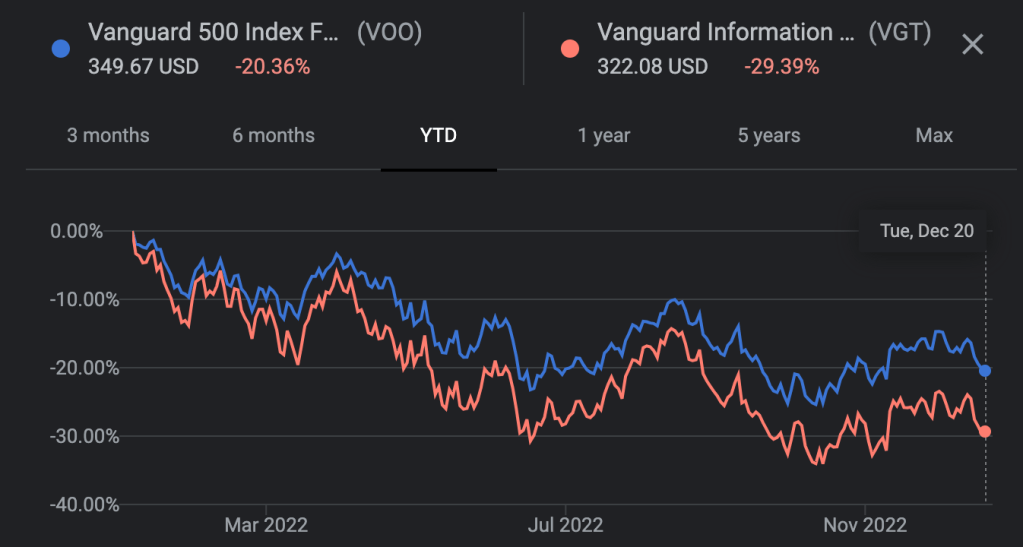

Prediction 4: More Air Out of the Tech Stock Sector: The 2022 market correction will be concentrated on high growth tech, and largely not affect other sectors as deeply. It’s possible that this isn’t a prediction since it’s already started, but we’ll continue to see valuations of technology stocks come back down to be closer to historical revenue multiple levels. This is primarily going to be driven by interest rate hikes, which will change equity analysts DCF models. That will influence narrative, which will compound the correction. To put this to a metric, I think the broad S&P (VOO) will outperform technology ETFs (VGT) in 2022.

Final Grade: ✅✅ Correct.

Here’s the chart:

While the S&P 500 is down about 20% for the year, the Technology-focused ETF is down nearly 30% over the same time period. At the time I wrote this, it was a pretty easy prediction, so I’m not going to take too big of a victory lap here. That said, markets can be strange and I think 2022 was worse than most of us imagined at the start of the year. Here’s to hoping 2023 is much better for all sectors.

Prediction 5: For(d) The Win The Ford 150 Electric is going to be a massive hit, and will be a watershed moment for creating mainstream consumer demand for EVs where Tesla hasn’t been able to reach – the great American Red State truck owner. The 2022 Lightning model sells out by March

Final Grade: ❌ Mostly incorrect.

The Lightening didn’t sell out. There’s still inventory available. That said, sales are going well above expectations. Per The Driven:

Since its launch in June, Ford has sold a total of 8,760 units. With numbers like that, it’s unsurprising that the Lightning is one of Ford’s fastest-turning vehicles on dealer lots, averaging only 8 days. Ford’s share of the US electric vehicle market increased by 3% over September 2021, reaching 7%.

While the objective metric wasn’t met, it’s very exciting to see adoption of EVs in the truck market. My miss here likely says less about demand for the truck than it does about my understanding of Ford’s manufacturing operations.

Prediction 6: NIMBYs Heat Housing Prices. The housing market will continue to heat up. The incoming interest rate hikes will do little to alleviate the core problem of housing in the United States, which is that there isn’t enough supply in places where people want to live. We will continue to see housing values run up another 10% on average in the US in 2022, which is far above historical norms.

Final Grade: ✅✅ Correct

According to the St. Louis Fed, the median house prince in the U.S. rose 10.4% YoY, between Q3 2021 and Q3 2022. While the metric is right, I don’t think my reasoning was right. Consensus seems to be attributing most of this to inflation, although there are plenty of narratives that support the low supply theory.

Prediction 7: Congress Grinds Down/ The Federal government passes no major piece of legislation in 2022. Build Back Better goes on the shelf as inflation continues its rise and the election cycle comes up. The democrats do not use budget reconciliation to pass it, fearing a centrist and independent backlash in the upcoming elections.

Despite this restraint, the Democrats lose control of the House and the Senate in 2022. This will happen even as the Biden administration accomplished some pretty remarkable things in his first year (COVID relief, infrastructure, presidential normalcy). Putting Obama aside, the left has an uncanny ability to steal defeat from the jaws of victory, and the upcoming mid-term election will be no different.

Final Grade: ❌❌ Totally Incorrect.

I must be letting the cynical Twitterati infect me, because I was convinced that everyone in congress would retreat to their corners and not come out until after the mid-term election. This year alone, bipartisan groups passed the Chips and Science Act, the Respect For Marriage Act, funding for Ukraine and a federal spending bill. The democrats also managed to pull off the Inflation Reduction Act through reconciliation which, while not bipartisan, took some impressive wrangling. By any measure, this congress was very productive and I think it speaks to the fact that our institutions still ultimately work.

In addition to the legislation, I also thought the democrats would do worse in the mid-terms than they did. Double wrong! Thanks to the Supreme Court and election denying candidates, the democrats did extremely well this year.

Prediction 8: Rules of the Crypto Road: The SEC firms up securities policy guidance for blockchain technologies, better defining what crypto assets are securities.

Final Grade: ✅ Mostly Correct

As far as I understand, while there is an ongoing debate over whether crypto tokens should be regulated as commodities or securities, there is momentum forming around the idea that tokens are investable securities, and can be regulated under existing securities law, negating the need for additional legislation. I am phenomenally dumb on this topic, but I would imagine events like the SBF/FTX fraud debacle will compound this narrative. The crypto markets largely act like financial markets, it stands to reason that the SEC will take the wheel here.

Prediction 9: Russian Gas Fees. Russia does not invade Ukraine, and they get their gas line to Germany deal done. There will be much much posturing, but the US, EU and Russia figure out a path forward without an escalated military conflict. There is too much shared interest in compromise.

Final Grade: ❌❌❌❌❌❌❌❌❌ Could Not Have Been More Wrong.

There’s no point in spilling any ink on this, I was completely, utterly incorrect on this one.

Leave a comment